Executive Summary

Ecosystem Strength, Stability, and Challenges Ahead

As we mark a year of innovation amidst war, beginning with the profound impact of the tragic events of October 7th, 2023, the Israeli high-tech sector has demonstrated remarkable strength and adaptability. During Q1-Q3 2024, Israel’s tech ecosystem navigated a complex environment shaped by global economic volatility and ongoing geopolitical tensions. Despite these challenges, the sector continued to attract substantial global investment, reflecting both its stability and strategic importance.

Highlights

Private Funding Rebound: Estimated private funding grew by 30% year-on-year, with Q1-Q3 2024 estimated at $10.2 billion (based on $7.7 billion of reported deals and $2.5 billion in estimated deals), compared to an estimated $7.8 billion during Q1-Q3 2023 (based on $6.6 billion in reported deals). This growth underscores the ecosystem’s ability to attract investor confidence, even amidst market instability and conflict.

M&A Activity as a Vote of Confidence: M&A activity surged 40% to $12 billion in Q1-Q3 2024, up from $8.6 billion during the same period in 2023. This growth, driven largely by exits in business software and health tech, highlights sustained global confidence in Israel’s innovative capabilities, despite broader economic uncertainties.

Parity with the U.S.: Israel’s tech sector mirrored U.S. trends, with both markets achieving year-on-year increases in private funding despite quarterly declines. However, Israel saw a more pronounced year-on-year decrease in the number of rounds compared to the U.S., underscoring the need for cautious optimism. Nonetheless, Israel outperformed Europe in terms of relative funding stability, reinforcing its competitiveness on the global stage.

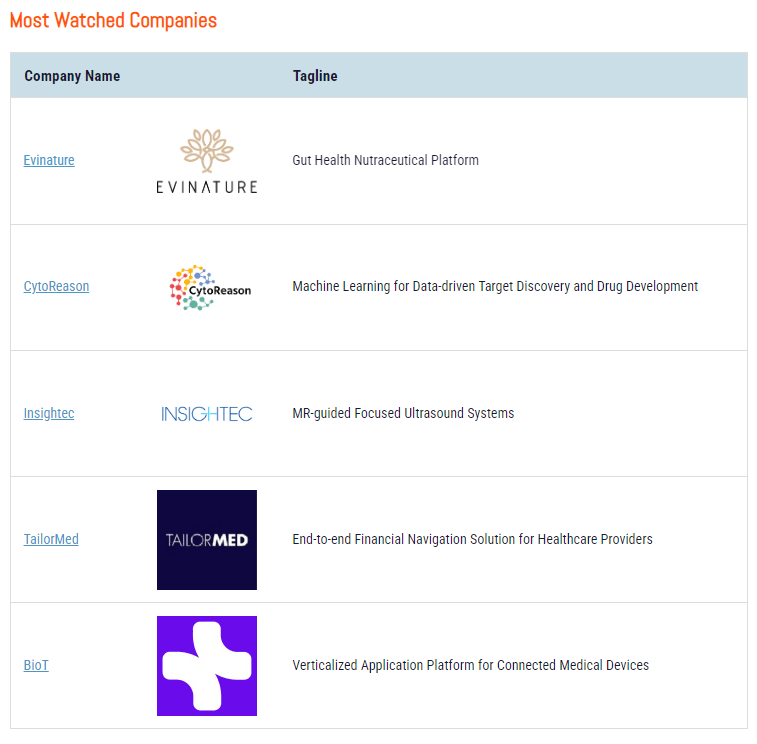

Areas to Watch

Selective Investment Climate: The number of investment rounds dropped from 206 in Q2 to 162 in Q3, marking a consistent year-on-year quarterly decline of about 10% since the beginning of 2024. Notably, B-round funding has been particularly impacted, highlighting an increasing investor focus on selectivity. This trend reflects a more cautious approach by investors, influenced by macroeconomic and geopolitical factors. While total funding remains substantial, there is an evident shift toward scale and quality over quantity.

Public Funding Decline: Changing global perceptions around Israel and Israeli companies, alongside a broader decrease in IPOs, has led to a significant decline in public funding events for Israeli companies. Additionally, since April 2024, the Finder Nasdaq Index has tracked an expanding performance gap between Israeli public companies and the Nasdaq Equal-Weighted Index, suggesting growing concerns about public market performance.

Changing Global Investor Dynamics: The number of active global investors has decreased by just under 30% since the onset of the conflict, stabilizing at this lower level. However, those who remain active demonstrate a strong commitment to Israel’s tech ecosystem, with Sequoia Captial notably returning as a leading participant among global investors.

Sector Highlights

Health Tech: Health tech funding increased to $350 million, reflecting continued investor interest in this critical sector.

Business Software: A standout performer, business software raised $1.4 billion in Q3 2024, with $1 billion attributed to the high-profile startup Safe Superintelligence.

Cybersecurity: Following a strong first half, cybersecurity funding declined to $400 million in Q3, reflecting a slight cooling in the sector.

Fintech & Insurtech: Funding in these sectors fell to $77 million, indicating increased volatility.

Climate Tech: Funding in climate tech dropped to $49 million, showing fluctuating investor confidence in this emerging area.

In conclusion, Israel’s tech sector remains strong and stable, though challenges lie ahead. Private funding trends and M&A activity reflect cautious but sustained investor interest, with robust performance in business software and health tech. However, the decline in early-stage and B-round funding, along with decreased public funding, will be key areas to monitor for future growth and long-term sector sustainability.

Yariv Lotan,

VP of Digital Products, Development, Data and Insights

Specific Part to Watch with Australian-Israeli Trade:

Health Tech

The health tech sector recovered slightly in Q3 2024, with private funding reaching $349 million, up from $322 million in Q2. This rise in private funding was contrary to the general trend. While the sector still faces challenges, the increase reflects ongoing interest in health-related technologies. Private funding dropped by 37% year-over-year, from $1.31 billion in Q1-Q3 2023 to $831 million in Q1-Q3 2024. Public funding remained minimal, with only $80 million raised through PIPE, and no significant public offerings recorded this quarter.

Evinature is a spin-off from SHEBA practicing in evidence-based protocols for a healthy gut

Developed by Leading IBD Researchers

The CurQD® Protocol was developed in Sheba Medical Center (SMC), one of Newsweek’s best 10 hospitals in the world.

The protocol evolved from the clinical experience and placebo-controlled trials led by Nir Salomon, Director of the Integrative Gastroenterology unit at SMC, and Professor Shomron Ben-Horin MD, Chief of the Gastroenterology Department & Director of the Gastro-Immunology Research Laboratory at SMC.

Full Report: Q3 2024 Israeli-Tech Report | Startup Nation Finder